In our March Markets in Motion and our Envestnet hosted webinar, we focused on the need in a financial crisis (whatever the origin) to help craft easy-to-understand, longer-term narratives for Advisors and their Clients. Panicking and abandoning diversified investment strategies during volatility and market crashes/surges is a time-tested losing proposition. This update is going to center specifically on our current view, with an intent to update everyone as we process critical data and information from our proprietary research as well as corporate and governmental sources.

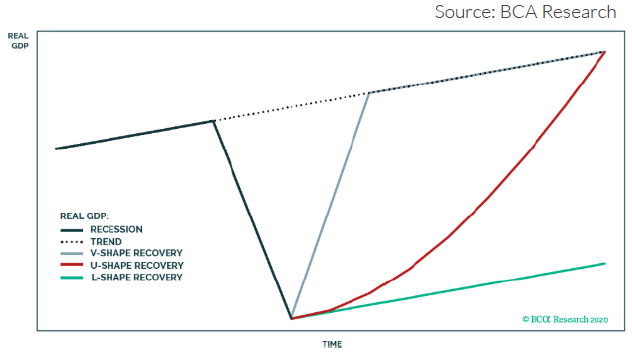

1) The economic recovery from the recession-conditions we have entered is most likely “U”-shaped.

We have notedthat “event driven” recessions aretypically shorter in duration and areaccompanied by severe initial marketcrashes followed by quick rebounds ineconomic and market conditions—the “V”-shaped recovery. Our data isindicating that we will not get a reliableforecast of top-down corporate earningsuntil at least late 3rd or early 4th quarterthis year. That injects more uncertainty

over a longer period of time, thus:

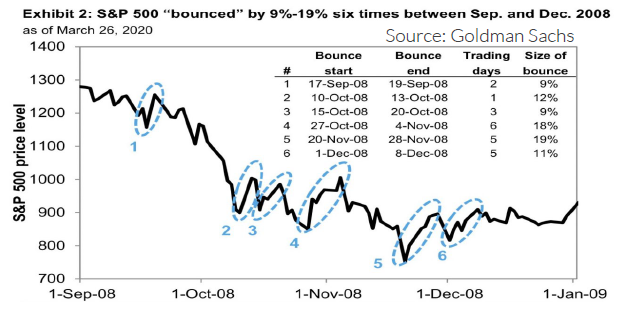

2) Market volatility will likely stay high during this longer-than-anticipated period of uncertainty.

We believe for now–dependent on additional dataon the economy re-opening and re-building, as wellas very large improvements in virus testing andtreatment therapies– that the equity markets willbe subject to a handful of “ups and downs.” The best proxy we have is the last meltdown in 2008-09, where an initial crash was followed by six sizablebounces, leading us to conclude:

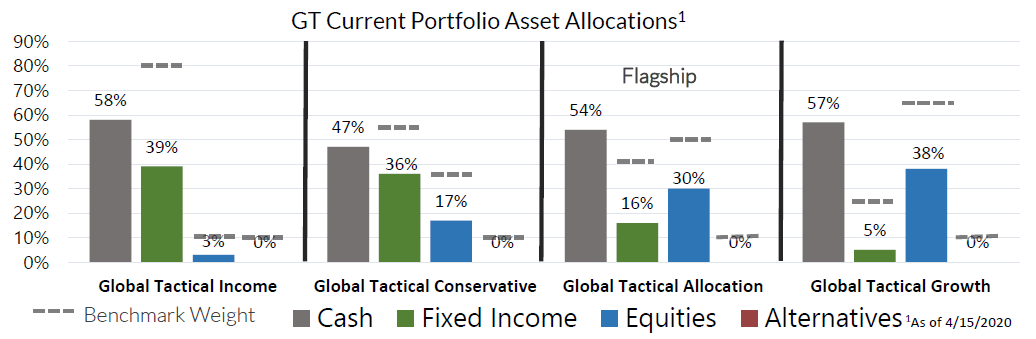

3) That a conservative portfolio of high quality equities and a recession-level amount of short term treasuries and near cash equivilents is the prudent tactical allocation right now.

If there’s a vaccine or a massive improvement in testing capibilitiesbetween now and the 4th quarter, which results in a far faster ramp-up of economic activity and resultant confidence incorporate earnings estimates, then we will capture a decent amount of upside and have opportunities to employ cash for our growing “post-virus” shopping list. To go back to where we started—we’d be delighted with a quick “V” shaped economic andmarket recovery, which equity prices seem to be signalling currently, but are not convinced we want to bet a large amount of risk on that scenario. Adaptability to new data is embedded in the GT process, and we will be vigilent in protecting client assets and alert as opportunities unfold.

With this month’s positioning, we recognized that credit and financial conditions have continued to deteriorate while risk assets rallied sharply, and we took steps to de-risk our portfolios; we sold our US value equities, European equities, emerging market equities, preferred stocks and commodities to raise cash equivalents. We will continue to be data dependent and evaluate further changes in positioning.

Finally, know that all our Strategies will adapt to fundamental or rules-based, not emotional influences. We seek opportunities for solid risk adjusted returns and to preserve capital in asset market downturns.

Recent Portfolio Changes

We exited our positions in US Value equities, European Equities, Emerging Market Equities, Preferred Stocks and Commodities to raise cash equivalents. After a sharp rally for risk assets, we took steps to meaningfully de-risk our portfolios amid unprecedented volatility and deteriorating financial conditions.

Please do not hesitate to contact our team with any questions. You can get more information by calling (800) 642-4276 or by emailing AdvisorRelations@donoghue.com. Also, visit our Contact Page to learn more about your territory coverage.

Best regards,

John A. Forlines, III

1 Information as of 4/15/2020. Individual account allocations may differ slightly from model allocations

2 Contains international exposure

Past performance is no guarantee of future results. The material contained herein as well as any attachments is not an offer or solicitation for the purchase or sale of any financial instrument. It is presented only to provide information on investment strategies, opportunities and, on occasion, summary reviews on various portfolio performances. The investment descriptions and other information contained in this Markets in Motion are based on data calculated by W.E. Donoghue & Co., LLC (W.E. Donoghue) and other sources including Morningstar Direct. This summary does not constitute an offer to sell or a solicitation of an offer to buy any securities and may not be relied upon in connection with any offer or sale of securities.

The views expressed are current as of the date of publication and are subject to change without notice. There can be no assurance that markets, sectors or regions will perform as expected. These views are not intended as investment, legal or tax advice. Investment advice should be customized to individual investors objectives and circumstances. Legal and tax advice should be sought from qualified attorneys and tax advisers as appropriate.

The JAForlines Global Tactical Allocation Portfolio composite was created July 1, 2009. The JAForlines Global Tactical Income Portfolio composite was created August 1, 2014. The JAForlines Global Tactical Growth Portfolio composite was created April 1, 2016. The JAForlines Global Tactical Conservative Portfolio composite was created January 1, 2018.

Results are based on fully discretionary accounts under management, including those accounts no longer with the firm. Individual portfolio returns are calculated monthly in U.S. dollars. Policies for valuing portfolios and calculating performance are available upon request. These returns represent investors domiciled primarily in the United States. Past performance is not indicative of future results. Performance reflects to re-investment of dividends and other earnings.

Net returns are presented net of management fees and include the reinvestment of all income. Net of fee performance was calculated using a model fee of 1% representing an applicable wrap fee. The investment management fee schedule for the composite is: Client Assets = All Assets; Annual Fee % = 1.00%. Actual investment advisory fees incurred by clients may vary.

W.E. Donoghue & Co., LLC (Donoghue) claims compliance with the Global Investment Performance Standards (GIPS®).

The Blended Benchmark Moderate is a benchmark comprised of 50% MSCI ACWI, 40% Bloomberg Barclays Global Aggregate, and 10% S&P GSCI, rebalanced monthly.

The Blended Benchmark Conservative is a benchmark comprised of 35% MSCI ACWI, 55% Bloomberg Barclays Global Aggregate, and 10% S&P GSCI, rebalanced monthly.

The Blended Benchmark Growth is a benchmark comprised of 65% MSCI ACWI, 25% Bloomberg Barclays Global Aggregate, and 10% S&P GSCI, rebalanced monthly.

The Blended Benchmark Income is a benchmark comprised of 80% Bloomberg Barclays Global Aggregate Bond Index, 10% MSCI ACWI, and 10% S&P GSCI, rebalanced monthly.

The MSCI ACWI Index is a free float adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The S&P GSCI® is a composite index of commodity sector returns representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum of commodities. The Bloomberg Barclays Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers.

Index performance results are unmanaged, do not reflect the deduction of transaction and custodial charges or a management fee, the incurrence of which would have the effect of decreasing indicated historical performance results. You cannot invest directly in an Index. Economic factors, market conditions and investment strategies will affect the performance of any portfolio, and there are no assurances that it will match or outperform any particular benchmark.

Policies for valuing portfolios, calculating performance, and preparing compliant presentations are available upon request. For a compliant presentation and/or the firm’s list of composite descriptions, please contact 800‐642‐4276 or info@donoghue.com.

W.E. Donoghue is a registered investment adviser with United States Securities and Exchange Commission in accordance with the Investment Advisers Act of 1940.