The US election has passed without any big surprises. In Our US Election Markets in Motion: Part 1, our October 28 Webinar, and our recent Short-term Outlook, we favored three election outcomes:

- Joe Biden is the favorite to be the next president and we believe there will be a resolution within a fewdays.

– Joe Biden was projected to win by major media outlets just days after the election. Trump has not officially conceded, but there is no path to victory – there aren’t enough outstanding votes for him to move past Biden, recounts won’t flip enough states (if any), and there’s no evidence of significant fraud. - We discounted a “blue wave” with republicans likely to maintain control of the Senate.

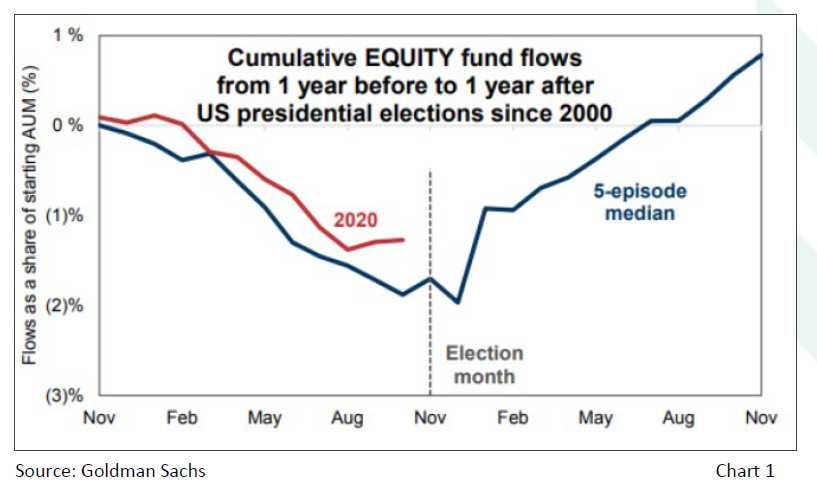

– Republicans are likely to maintain control of the Senate. With a 50 to 48 advantage after Super Tuesday, two runoff elections in Georgia will decide a majority in the senate, where Republicans are favored in both elections. - This scenario will be short-term bullish for risk assets – in our view, simply clearing the event risk off the table by getting past the election was itself a key upside catalyst for risk assets. (chart 1).

– Risk assets have rallied sharply since election day – the S&P 500 is up ~9%

So, what are investment implications moving forward?

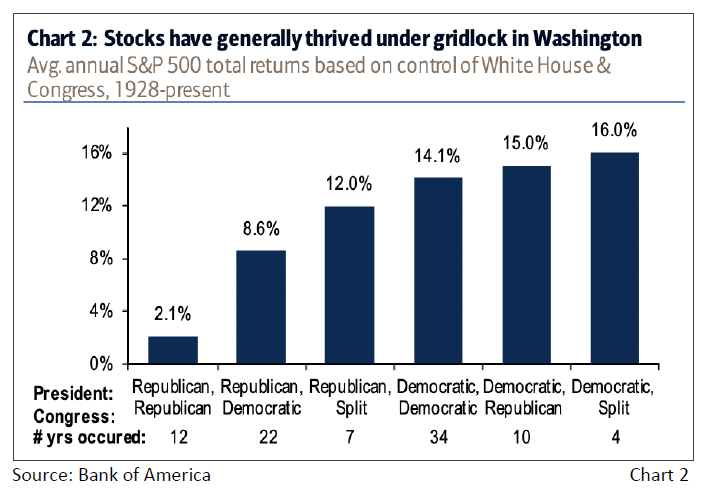

We believe a Biden presidency and GOP senate are good for risk markets. Markets like predictable trade policy and a divided congress. This reduces the odds of tax hikes or new regulations and is a relief to investors expecting a less business-friendly environment. In fact, there’s historical precedence of better equity performance during times of gridlock (chart 2).

However, for the same reasons checks and balances are positive for markets, such a balance of power poses risks to the near-term path of fiscal stimulus. Nevertheless, we are optimistic a targeted package still gets done for several reasons: 1) the economy needs it, 2) borrowing rates are at historic lows, and 3) public opinion demands fiscal relief (chart 3).

Most important to this favorable backdrop, we expect monetary policy will continue to be accommodative.

A Shot in the Arm

Encouraging news has developed on the vaccine front. Both Pfizer and Moderna announced their Covid-19 trials immunized more than 95% of participants! Both vaccines take a similar approach by leveraging messenger RNA technology – which helps validate our optimism. The results are preliminary, but both companies are expected to seek emergency use authorization from the FDA and if all goes well, start distributing doses by the end of the year with the potential of inoculating the entire US population by mid-2021. While there are still hurdles, ten other vaccines are in late stage trials, and it is now widely expected a safe and effective vaccine will become available by Q1 2021!

This news paves the way for a rapid rebound in economic activity next year but the path to ending the pandemic is likely to be a bumpy one. There’s a duration mismatch between the current resurgence of Covid-19 (record cases & hospitalizations) and the successful rollout of a vaccine. This will weigh on economic growth in the near-term and reduces the odds of a disorderly rise in bond yields that could sink the stock market. Therefore, we expect that T.I.N.A will continue to dominate investor behavior into year-end.

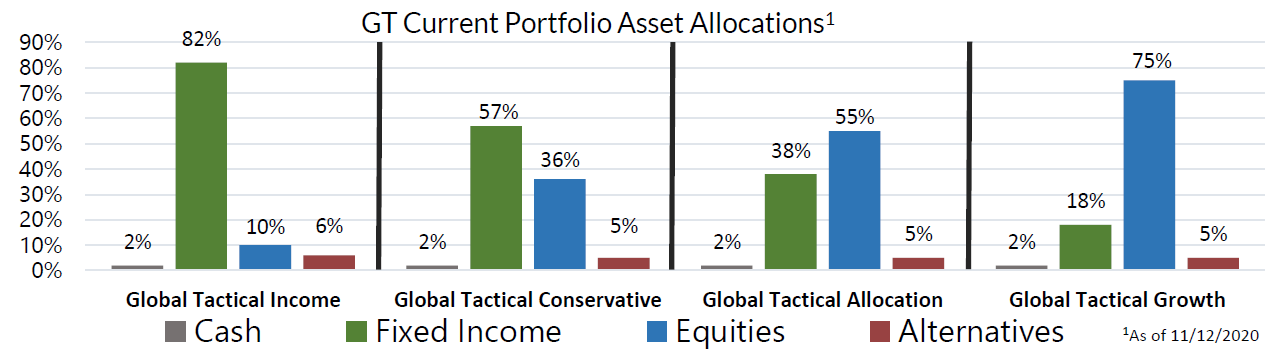

With this month’s moves, we exited our hedge in long-dated treasury bonds. Bond yields have established a floor and no longer provide the same diversification. We increased risk exposure by adding to our positions in large-cap growth stocks and short-term high yield bonds. We maintain an agile position in short-term bonds and cash in order to take advantage of any pullbacks in risk that are not related to fundamental areas of real concern.

Finally, know that all our Strategies will adapt to fundamental or rules – based, not emotional influences. We seek opportunities for solid risk adjusted returns and to preserve capital in asset market downturns.

Recent Portfolio Changes

We exited our position in long-term Treasuries. Nominal yields have modestly risen; we expect this will continue post-election and into next year.

We added to our position in Large Cap Growth equities. We expect that growth stocks should continue to outperform in an environment of weak economic growth and lower-for-longer interest rates.

We added to our position in High Yield. We believe that High Yield is an attractive asset class that increases the overall risk exposure and yield of the portfolio.

Please do not hesitate to contact our team with any questions. You can get more information by calling (800) 642-4276 or by emailing AdvisorRelations@donoghue.com. Also, visit our Contact Page to learn more about your territory coverage.

Best regards,

John A. Forlines, III

1 Information as of 11/12/2020. Individual account allocations may differ slightly from model allocations

2 Contains international exposure

Past performance is no guarantee of future results. The material contained herein as well as any attachments is not an offer or solicitation for the purchase or sale of any financial instrument. It is presented only to provide information on investment strategies, opportunities and, on occasion, summary reviews on various portfolio performances. The investment descriptions and other information contained in this Markets in Motion are based on data calculated by Donoghue Forlines LLC (formerly W.E. Donoghue, LLC) and other sources including Morningstar Direct. This summary does not constitute an offer to sell or a solicitation of an offer to buy any securities and may not be relied upon in connection with any offer or sale of securities.

The views expressed are current as of the date of publication and are subject to change without notice. There can be no assurance that markets, sectors or regions will perform as expected. These views are not intended as investment, legal or tax advice. Investment advice should be customized to individual investors objectives and circumstances. Legal and tax advice should be sought from qualified attorneys and tax advisers as appropriate. The Donoghue Forlines Global Tactical Allocation Portfolio composite was created July 1, 2009. The Donoghue Forlines Global Tactical Income Portfolio composite was created August 1, 2014. The Donoghue Forlines Global Tactical Growth Portfolio composite was created April 1, 2016. The Donoghue Forlines Global Tactical Conservative Portfolio composite was created January 1, 2018.

Results are based on fully discretionary accounts under management, including those accounts no longer with the firm. Individual portfolio returns are calculated monthly in U.S. dollars. Policies for valuing portfolios and calculating performance are available upon request. These returns represent investors domiciled primarily in the United States. Past performance is not indicative of future results. Performance reflects to re-investment of dividends and other earnings.

Net returns are presented net of management fees and include the reinvestment of all income. Net of fee performance was calculated using a model fee of 1% representing an applicable wrap fee. The investment management fee schedule for the composite is: Client Assets = All Assets; Annual Fee % = 1.00%. Actual investment advisory fees incurred by clients may vary.

The Benchmark Moderate is the HFRU Hedge Fund Composite. The HFRU Hedge Fund Composite USD Index is designed to be representative of the overall composition of the UCITS-Compliant hedge fund universe. It is comprised of all eligible hedge fund strategies; including, but not limited to equity hedge, event driven, macro, and relative value arbitrage.

The Blended Benchmark Conservative is a benchmark comprised of 80% HFRU Hedge Fund Composite and 20% Bloomberg Barclays Global Aggregate, rebalanced monthly.

The Blended Benchmark Growth is a benchmark comprised of 80% HFRU Hedge Fund Composite and 20% MSCI ACWI, rebalanced monthly.

The Blended Benchmark Income is a benchmark comprised of 60% HFRU Hedge Fund Composite and 40% Bloomberg Barclays Global Aggregate, rebalanced monthly.

The MSCI ACWI Index is a free float adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The HFRU Hedge Fund Composite USD Index is designed to be representative of the overall composition of the UCITS-Compliant hedge fund universe. It is comprised of all eligible hedge fund strategies; including, but not limited to equity hedge, event driven, macro, and relative value arbitrage. The underlying constituents are equally weighted. The Bloomberg Barclays Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers.

Index performance results are unmanaged, do not reflect the deduction of transaction and custodial charges or a management fee, the incurrence of which would have the effect of decreasing indicated historical performance results. You cannot invest directly in an Index. Economic factors, market conditions and investment strategies will affect the performance of any portfolio, and there are no assurances that it will match or outperform any particular benchmark.

Policies for valuing portfolios, calculating performance, and preparing compliant presentations are available upon request. For a compliant presentation and/or the firm’s list of composite descriptions, please contact 800‐642‐4276 or info@donoghueforlines.com.

Donoghue Forlines is a registered investment adviser with United States Securities and Exchange Commission in accordance with the Investment Advisers Act of 1940. Registration does not imply a certain level of skill or training.