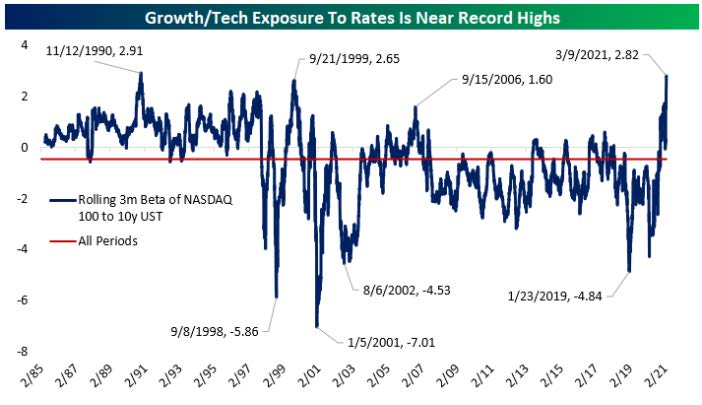

Even though the underlying force behind bond market moves is an improving economic outlook, higher rates are raising fears that the equity rally could fizzle. The recent volatility has been concentrated in growth/technology stocks that are seen as vulnerable to higher discount rates. In fact, the beta of the Nasdaq 100 to treasuries has neared record levels. (Chart 1)

So, is good economic news bad news for risk assets? No, we believe good news really is good news.

In our view, the surge in bond yields is reflective, not constraining. In other words, the level of yields remains accommodative considering the economic environment. Historically, rising yields have only hurt stocks in response to hawkish central bank rhetoric. This is clearly not the case today. Chair Powell via the Fed’s new framework has downplayed inflation risks, stressing that the US economy is “a long way” from their goals.

And inflationary hopes have so often disappointed because of secular deflationary trends that are not done playing out. After an initial surge of leisure and services spending, we think consumption reverts to trend as structural forces reassert themselves. Therefore, there will be a short-term pickup in inflation because of base effects from 2020, but we believe these risks are already priced into markets. (Chart 2)

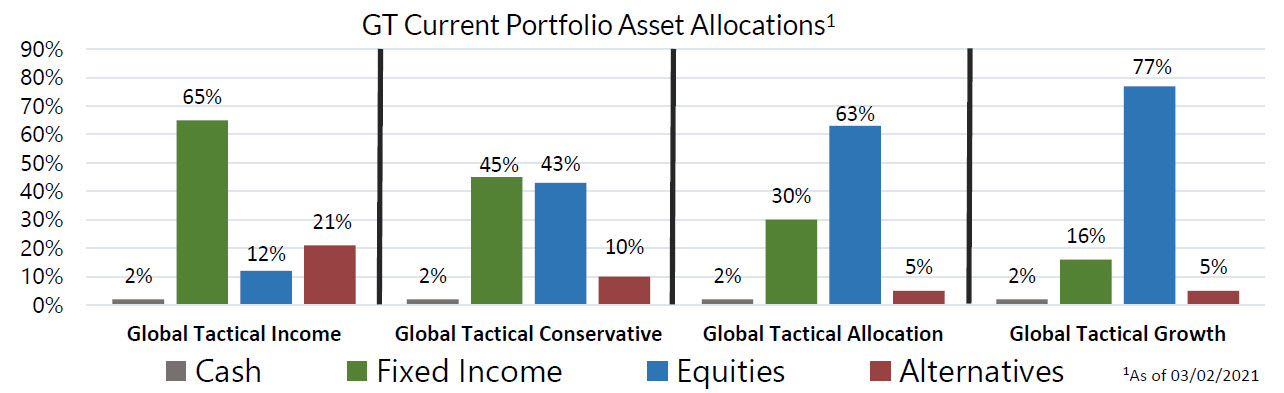

Given a broad economic rebound and well-contained inflation, we continue to overweight equity exspoure and remain convicted in our positions. The bond selloff is exhausted (for now), but when rates do move higher again, we expect the unusual correlation to growth stocks to subside.

With this month moves, we sold our short-term bond position to put capital to work in emerging market equities and initiated a tactical position in long duration bonds to take advantage of the outsized move in yields.

Finally, know that all our Strategies will adapt to fundamental or rules-based, not emotional influences. We seek opportunities for solid risk adjusted returns and to preserve capital in asset market downturns.

1 Information as of 03/02/2021. Individual account allocations may differ slightly from model allocations.

Recent Portfolio Changes

We exited our cash equivalent position in favor of Emerging Market Equities and a small Long-Term U.S. Treasuries position. Tactical moves to add risk in a position at a more attractive reentry point. The Treasury add is a mean reversion play on a very sharp increase in long-dated yields that we feel may have been overdone or “too much too soon.”

We initiated a position in U.S. Infrastructure Development. We believe this space will benefit from a potential increase in infrastructure activity in the United States, a main priority of the Biden Administration.

We initiated a position in Minimum Volatility Emerging Market Equities. To maintain cyclical exposure in our barbell approach, while mitigating downside risk due to potential extended conditions. We believe that international stocks should benefit from improving global growth and a weak USD environment as the year progresses.

1 Information as of 03/02/2021. Individual account allocations may differ slightly from model allocations

John A. Forlines III

Chief Investment Officer

Past performance is no guarantee of future results. The material contained herein as well as any attachments is not an offer or solicitation for the purchase or sale of any financial instrument. It is presented only to provide information on investment strategies, opportunities and, on occasion, summary reviews on various portfolio performances. The investment descriptions and other information contained in this Markets in Motion are based on data calculated by Donoghue Forlines LLC (formerly W.E. Donoghue, LLC) and other sources including Morningstar Direct. This summary does not constitute an offer to sell or a solicitation of an offer to buy any securities and may not be relied upon in connection with any offer or sale of securities.

The views expressed are current as of the date of publication and are subject to change without notice. There can be no assurance that markets, sectors or regions will perform as expected. These views are not intended as investment, legal or tax advice. Investment advice should be customized to individual investors objectives and circumstances. Legal and tax advice should be sought from qualified attorneys and tax advisers as appropriate.

The Donoghue Forlines Global Tactical Allocation Portfolio composite was created July 1, 2009. The Donoghue Forlines Global Tactical Income Portfolio composite was created August 1, 2014. The Donoghue Forlines Global Tactical Growth Portfolio composite was created April 1, 2016. The Donoghue Forlines Global Tactical Conservative Portfolio composite was created January 1, 2018.

Results are based on fully discretionary accounts under management, including those accounts no longer with the firm. Individual portfolio returns are calculated monthly in U.S. dollars. Policies for valuing portfolios and calculating performance are available upon request. These returns represent investors domiciled primarily in the United States. Past performance is not indicative of future results. Performance reflects to re-investment of dividends and other earnings.

Net returns are presented net of management fees and include the reinvestment of all income. Net of fee performance was calculated using a model fee of 1% representing an applicable wrap fee. The investment management fee schedule for the composite is: Client Assets = All Assets; Annual Fee % = 1.00%. Actual investment advisory fees incurred by clients may vary.

The Benchmark Moderate is the HFRU Hedge Fund Composite. The HFRU Hedge Fund Composite USD Index is designed to be representative of the overall composition of the UCITS-Compliant hedge fund universe. It is comprised of all eligible hedge fund strategies; including, but not limited to equity hedge, event driven, macro, and relative value arbitrage.

The Blended Benchmark Conservative is a benchmark comprised of 80% HFRU Hedge Fund Composite and 20% Bloomberg Barclays Global Aggregate, rebalanced monthly.

The Blended Benchmark Growth is a benchmark comprised of 80% HFRU Hedge Fund Composite and 20% MSCI ACWI, rebalanced monthly. The Blended Benchmark Income is a benchmark comprised of 60% HFRU Hedge Fund Composite and 40% Bloomberg Barclays Global Aggregate, rebalanced monthly.

The MSCI ACWI Index is a free float adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The HFRU Hedge Fund Composite USD Index is designed to be representative of the overall composition of the UCITS-Compliant hedge fund universe. It is comprised of all eligible hedge fund strategies; including, but not limited to equity hedge, event driven, macro, and relative value arbitrage. The underlying constituents are equally weighted. The Bloomberg Barclays Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers.

Index performance results are unmanaged, do not reflect the deduction of transaction and custodial charges or a management fee, the incurrence of which would have the effect of decreasing indicated historical performance results. You cannot invest directly in an Index. Economic factors, market conditions and investment strategies will affect the performance of any portfolio, and there are no assurances that it will match or outperform any particular benchmark.

Policies for valuing portfolios, calculating performance, and preparing compliant presentations are available upon request. For a compliant presentation and/or the firm’s list of composite descriptions, please contact 800‐642‐4276 or info@donoghueforlines.com.

Donoghue Forlines is a registered investment adviser with United States Securities and Exchange Commission in accordance with the Investment Advisers Act of 1940. Registration does not imply a certain level of skill or training.