Donoghue Forlines’ 2022 Global Markets Outlook

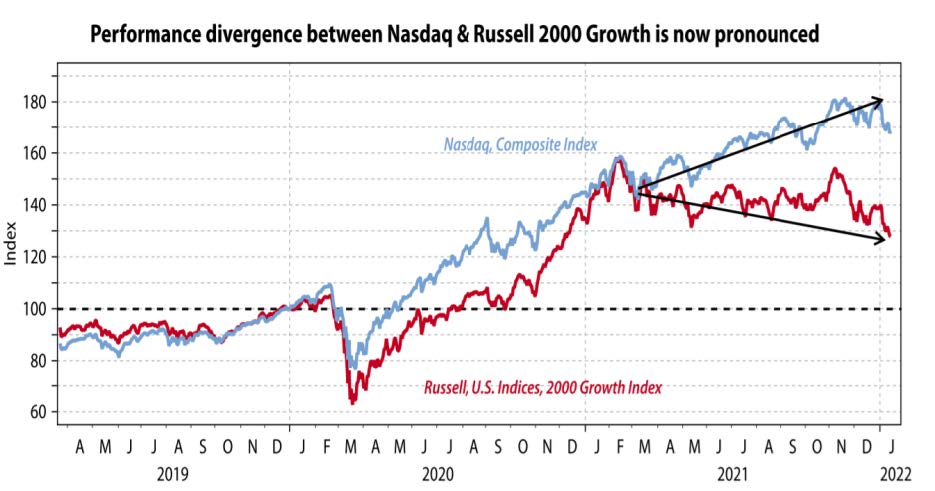

We are only a few weeks into the year, but investors must hope the adage “as January goes, so goes the year” does not hold true for 2022. After all, at the recent lows, the S&P 500 was down almost 10%, while the Nasdaq 100 was down almost 15%. And behind this pullback, pain in the most speculative parts of the market is starting to add up. SPACS, meme stocks, unprofitable tech, and crypto have all struggled. Momentum seems to have turned…so, is there anything to like about risk markets?

Gavekal

Surging COVID cases, the FOMC’s hawkish pivot, fiscal headwinds from Washington, extreme 2021 equity flows, and valuations are all legitimate concerns for investors, but the fact that we’re all talking about them suggests they’re already well known and mostly reflected in the market.

And selling the market based on headlines has never been a successful path to long-term outperformance.

And we believe, despite higher volatility, there are several reasons to remain constructive towards risk assets for 2022.

So, let’s throw away the headlines and review the current macro landscape and its implications on financial markets:

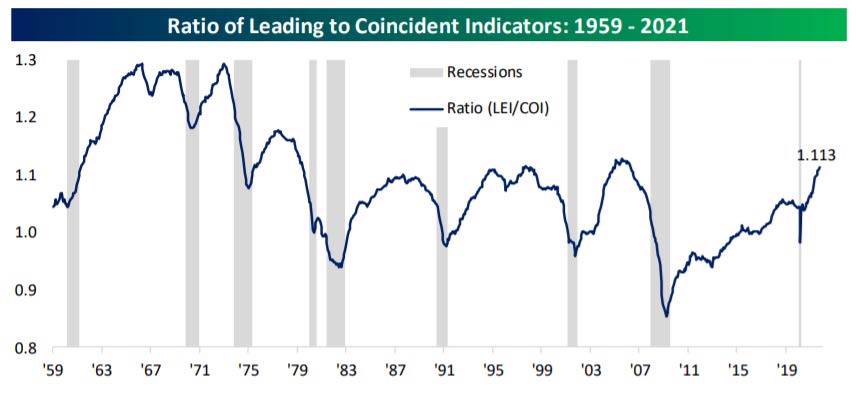

Growth

First, while growth will slow this year, we expect it will remain above trend. As we saw in 2021, average growth during economic expansions tends to be strongest early as pent-up demand leads to strong economic activity. While we believe we have reached “peak growth” for the cycle, at 20 months, the current expansion is still a baby. Post-WWII expansions have an average of 67 months, including three which have been longer than 100 months. It’s highly unlikely for the economy to move back into a recession so early in an expansion, and two indicators we track closely – the ratio of leading to coincident indicators and the US treasury yield curve – indicate that the recovery remains on track.

Leading indicators tend to always roll over well in advance of a recession. Now, the ratio is right at cycle highs indicating the health of the expansion remains sound.

Bespoke

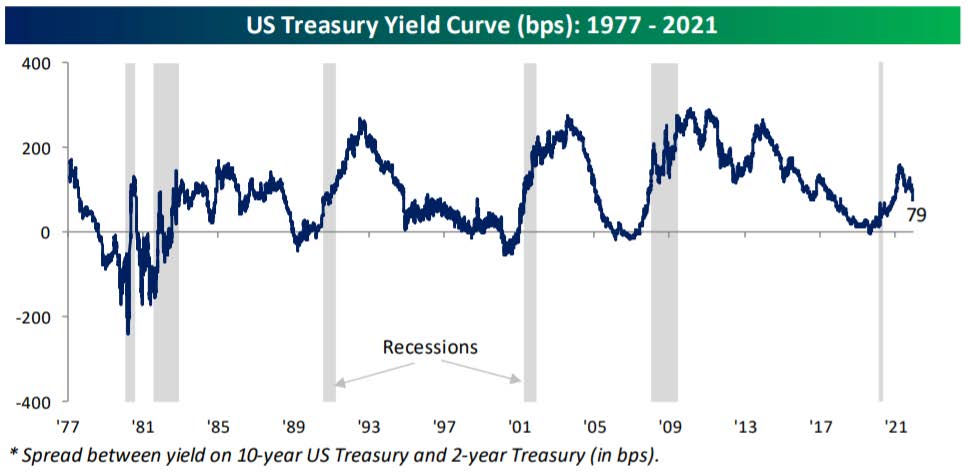

One of the most reliable predictors of an impending recession is the US Treasury yield curve and specifically the spread between the 2-year and 10- year notes. Almost every inversion of yield curve has been followed by a recession, and no recession since at least the mid-1970s has occurred without an inversion of the yield curve beforehand.

While the curve has flattened substantially since March 2021, it still hasn’t inverted, suggesting that outside of a major policy error by the Fed (or an exogenous shock), a recession starting in 2022 is unlikely.

Bespoke

We also discount the effect rising covid cases will have on the economy. Households and firms have learned to transact through covid over the last 2 years and the new Omicron variant appears to be less severe. We believe cases may have already peaked for the current wave.

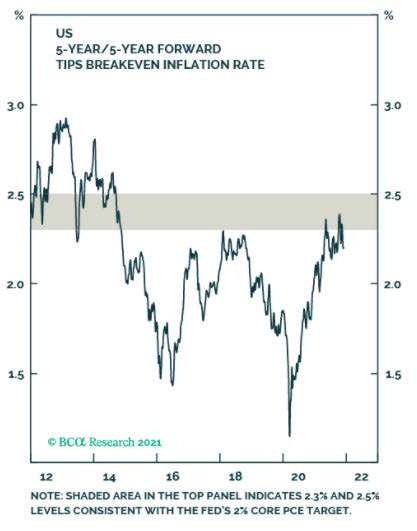

Inflation

Second, inflation is peaking, and in any case is not as bad as it looks. Inflation should dip over the next 6-to-9 months as the demand for goods moderates and supply-chain disruptions abate. When you strip out temporary distortions, inflation is not high by historical standards. The YoY inflation rates everyone is panicking about are misleading because they include large paybacks for the collapse in prices in the first year of the pandemic. If we look at two-year core rates that exclude energy and strip out Covid base effects, we find annualized US core PCE inflation is only 2.8%. Granted, even when the Covid reopening and energy effects drop out, inflation is unlikely to subside to the official 2% target rates. But after the shock of 7% headlines, inflation in the range of 3-4% in the US and even milder in other developed economies should be met with relief. On a longer timeline, inflation may continue to be structurally higher the next decade and investors will need to consider new diversifiers.

BCA Research

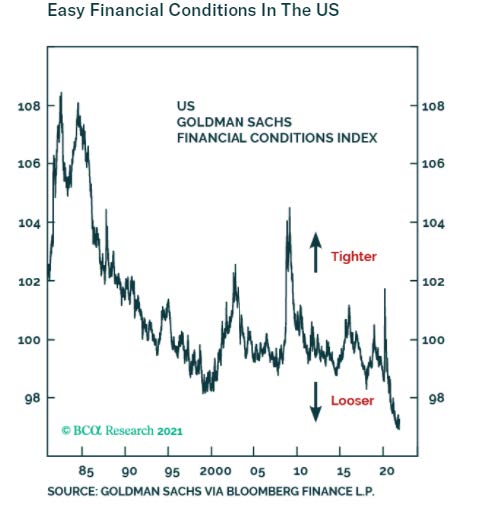

Policy

Finally, we expect these growth and inflation dynamics will allow the Fed to not significantly tighten monetary policy in 2022. While the Federal Reserve will expedite the tapering of asset purchases and will probably begin raising rates this summer, the Fed is unlikely to raise rates significantly. The respite from inflation next year will give the Fed some breathing space and a major tightening campaign is unlikely until mid-2023. The Fed has turned more hawkish, but the market has made a habit of over-estimating Fed moves. Reflective of this environment, real bond yields remain low and financial conditions remain easy. On the fiscal side, there will be much less stimulus, but with the dysfunction coming out of DC, tax hikes may also be less likely.

BCA Research

Financial Market Implications

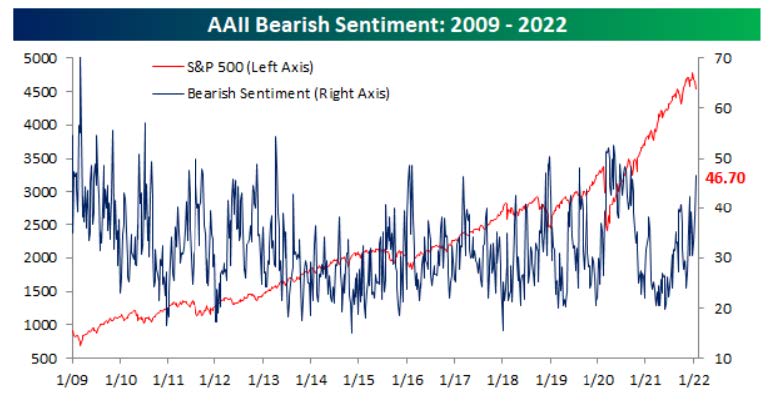

Equities

Our golden rule of investing is simple: Don’t bet against stocks unless you think that there is a recession around the corner, because equities and bear markets tend to overlap. Equity corrections can occur outside of recessionary periods. In fact, we are experiencing such a correction right now. Yet, with the percentage of bearish investors reaching the highest level in over 12 months in this week’s American Association of Individual Investors survey, chances are that the correction will not last much longer. A sustained decline in stock prices requires a sustained decline in corporate earnings; the latter normally only happens during economic downturns.

BCA Research

Equity valuations are still at lofty levels, but equities still look much more attractive than other asset classes. Don’t expect the outsized returns of the past year and a half, but the bull market should continue. Our equity exposure remains focused on quality. We will look to opportunities internationally as the recovery broadens out.

Fixed Income

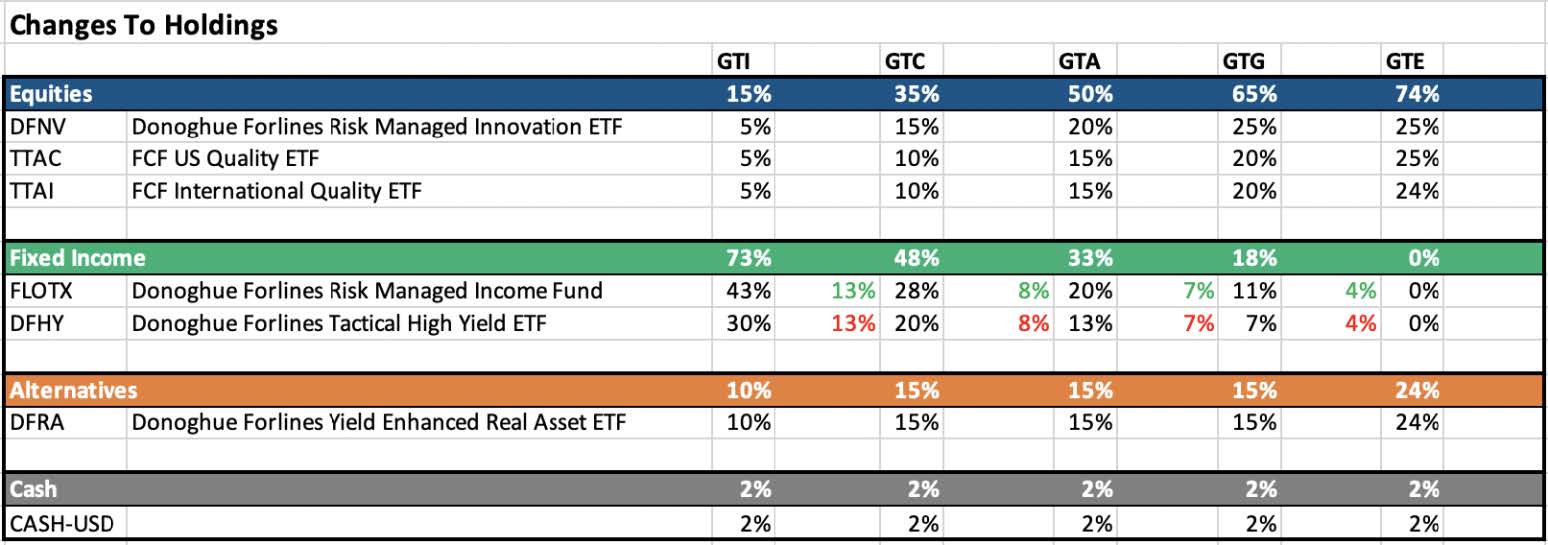

Opportunities in fixed income are limited. Treasury yields will continue to climb from historically low levels, but not fast enough to continue to stymie other risk assets. We remain underweight duration across all our portfolios and concentrate our exposure to high yield and floating rate markets for the current environment.

Alternatives

Diversification is not as simple as it used to be. Therefore, alternative assets have become an important part of our portfolios. We are allocated to quality real assets and believe they will be a crucial diversifier amid elevated long-term inflation. We’d expect to look for opportunities to increase our exposure to real assets in 2022.

We also expect volatility to increase, and with it, the importance of tactical asset allocation in 2022. We look forward to helpings clients navigate this environment!

Positioning for each of our portfolios as of 01/20/2022 are listed further down this page.

Recent Portfolio Changes

We reduced our position in our Tactical High Yield Fund and increased our position in our Risk Managed Income Fund. With interest rates rising and volatility increasing, we want to be overweight floating rate securities within our fixed income allocations.

Allocations as of 01/20/2022

We invite you to read our December Markets in Motion to learn about the Global Tactical Suite’s Next Generation of Investing. You can also get more information by calling (800) 642-4276 or by emailing AdvisorRelations@donoghueforlines.com. Also, visit our Sales Team Page to learn more about your territory coverage.

John A. Forlines III

Chief Investment Officer

Past performance is no guarantee of future results. The material contained herein as well as any attachments is not an offer or solicitation for the purchase or sale of any financial instrument. It is presented only to provide information on investment strategies, opportunities and, on occasion, summary reviews on various portfolio performances. The investment descriptions and other information contained in this Markets in Motion are based on data calculated by Donoghue Forlines LLC and other sources including Morningstar Direct. This summary does not constitute an offer to sell or a solicitation of an offer to buy any securities and may not be relied upon in connection with any offer or sale of securities.

The views expressed are current as of the date of publication and are subject to change without notice. There can be no assurance that markets, sectors or regions will perform as expected. These views are not intended as investment, legal or tax advice. Investment advice should be customized to individual investors objectives and circumstances. Legal and tax advice should be sought from qualified attorneys and tax advisers as appropriate.

The Donoghue Forlines Global Tactical Allocation Portfolio composite was created July 1, 2009. The Donoghue Forlines Global Tactical Income Portfolio composite was created August 1, 2014. The Donoghue Forlines Global Tactical Growth Portfolio composite was created April 1, 2016. The Donoghue Forlines Global Tactical Conservative Portfolio composite was created January 1, 2018. The Donoghue Forlines Global Tactical Equity Portfolio composite was created January 1, 2018.

Results are based on fully discretionary accounts under management, including those accounts no longer with the firm. Individual portfolio returns are calculated monthly in U.S. dollars. These returns represent investors domiciled primarily in the United States. Past performance is not indicative of future results. Performance reflects the re-investment of dividends and other earnings.

Net returns are presented net of management fees and include the reinvestment of all income. Net of fee performance, when composite accounts are 100% non-fee paying, was calculated using a model fee of 1% representing an applicable wrap fee. The investment management fee schedule for the composite is: Client Assets = All Assets; Annual Fee % = 1.00%. Actual investment advisory fees incurred by clients may vary.

The Donoghue Forlines Global Tactical Allocation Benchmark is the HFRU Hedge Fund Composite. The Blended Benchmark Conservative is a benchmark comprised of 80% HFRU Hedge Fund Composite and 20% Bloomberg Barclays Global Aggregate, rebalanced monthly. The Blended Benchmark Growth is a benchmark comprised of 80% HFRU Hedge Fund Composite and 20% MSCI ACWI, rebalanced monthly. The Blended Benchmark Income is a benchmark comprised of 60% HFRU Hedge Fund Composite and 40% Bloomberg Barclays Global Aggregate, rebalanced monthly. The Blended Benchmark Equity is a benchmark comprised of 60% HFRU Hedge Fund Composite and 40% MSCI ACWI.

The MSCI ACWI Index is a free float adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The HFRU Hedge Fund Composite USD Index is designed to be representative of the overall composition of the UCITS-Compliant hedge fund universe. It is comprised of all eligible hedge fund strategies; including, but not limited to equity hedge, event driven, macro, and relative value arbitrage. The underlying constituents are equally weighted. The Bloomberg Barclays Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers.

Index performance results are unmanaged, do not reflect the deduction of transaction and custodial charges or a management fee, the incurrence of which would have the effect of decreasing indicated historical performance results. You cannot invest directly in an Index. Economic factors, market conditions and investment strategies will affect the performance of any portfolio, and there are no assurances that it will match or outperform any particular benchmark.

Policies for valuing portfolios, calculating performance, and preparing compliant presentations are available upon request. For a compliant presentation and/or the firm’s list of composite descriptions, please contact 800‐642‐4276 or info@donoghueforlines.com.

Donoghue Forlines LLC is a registered investment adviser with the United States Securities and Exchange Commission in accordance with the Investment Advisers Act of 1940. Registration does not imply a certain level of skill or training.