In our Memorial Day Markets in Motion, we re-affirmed our macro view for the upcoming summer. Checking back in just before Labor Day, and our views have broadly played out.

- Economic momentum has slowed; but remains above trend.

- Monetary policy remains easy; runaway inflation fears have receded on the margin.

- Equites have continued to rally; and rotated away from value/cyclical into growth/quality.

But will the end of summer bring new Macro winds? We remain convicted in our views and believe these mid-cycle trends have longer to play out. But in a “post peak growth” environment, it is important to monitor the risks for signs that it is time to reduce risk exposure.

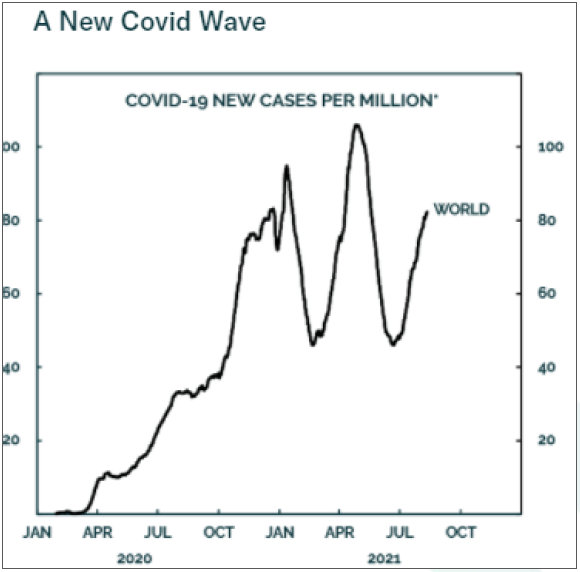

New Covid Variants

It’s been a year and a half since the emergence of Covid in the United States, but its impact on asset markets remains. The Delta variant continues to roll through the US and other countries. While the new strain does not seem to be any more deadly, it is a lot more contagious. CDC estimates suggest 40% more contagious than the original strain. While still vulnerable to the Delta variant, the symptoms of vaccinated individuals tend to be mild and non-life threatening.

The risk is likely not the delta variant but if a new variant emerges which is: 1) highly contagious; 2) vaccine resistant; and 3) as or more lethal than the original strain.

However, the current suite of vaccines confers substantial protection and if a vaccine-resistant strain does emerge, it is likely the vaccine producers could adjust to keep the virus at bay. And to some extent, firms and households have learned to transact through the pandemic. It would be highly unlikely we could drop to the level of economic activity in April 2020 again. As such, we only consider Covid to be a modest risk to financial markets … but not one we’re willing to ignore.

Tighter Monetary Policy

The latest angst in equity markets is the Fed preparing to taper asset purchases. Several Fed governors and regional presidents made media appearances over the last few weeks, each one presenting a timeline that sets up a tapering announcement before the end of this year. Nevertheless, we don’t expect the tapering announcement to move markets all that much.

In theory, monetary policy should mostly affect asset prices through interest rates, and not through central bank balance sheets, or other liquidity factors, unless these also move interest rates. Therefore, changes in the Fed’s balance sheet management should have relatively little effect on equity prices if investors believe that the Fed will keep interest rates unchanged for at least another year (and we don’t expect them to rise any time soon). This theory was tested in the 2013 “taper tantrum”. Equity markets dipped by only 6% in the month after Ben Bernanke announced the Fed’s 2013 taper and fully recovered within three weeks. The bull market then enjoyed a largely uninterrupted run for the next two and a half years, while the Fed reduced its bond purchases. It was only after the Fed raised the fed funds rate from 0.25% to 0.5% in December 2015 that the S&P 500 experienced a meaningful correction of -10.5%. Therefore, we don’t put a high risk on tighter monetary policy but we’ll monitor closely to see when the facts change.

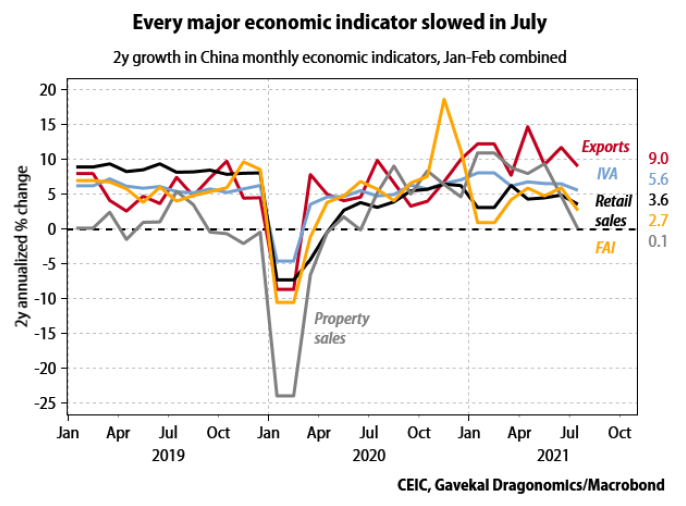

China

Chinese growth was notably weak in the first half of this year. One of the reasons for the slowdown is there zero-tolerance policy to Covid that has resulted in stricter restrictions. But the major reason has been the limited fiscal and monetary support – which now looks much less likely amid Beijing’s hawkish tone.

Another major concern is China’s step-up in regulation. China’s government has shown it is not afraid to shut down large and profitable industries in order to achieve its social goals. Chinese investors have been unnerved and have underperformed since last March.

Despite the mixed messages from Beijing, we expect authorities to ease policy in the coming months. We tried to take advantage of an opportunity on a tactical basis, but the fundamental and technical picture has changed. We expect regulatory crackdowns to continue to effect Chinese equities in the near-term. Therefore, we are tactically trimming our exposure to China within our portfolios. We still believe Chinese companies are a long-term growth opportunity and we’ll be looking for opportunities to re-enter in the future.

However, despite the idiosyncratic risks in China, our portfolios remain overweight equities with a bias in the US in growth/quality sectors.

Finally, know that all our Strategies will adapt to fundamental or rules-based, not emotional influences. We seek opportunities for solid risk adjusted returns and to preserve capital in asset market downturns.

Recent Portfolio Changes

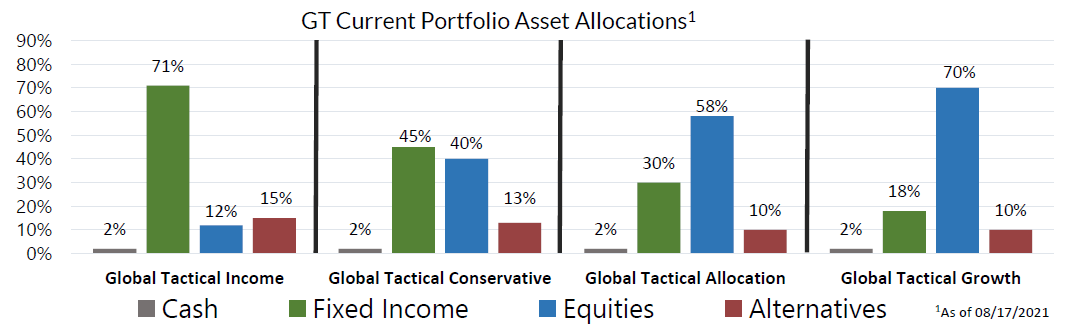

We exited our position in China and trimmed our position in emerging markets. China’s government has shown it is not afraid to shut down large and profitable industries in order to achieve its social goals. We expect the step-up in regulation to weigh on Chinese equities in the near-term.

1 Information as of 08/17/2021. Individual account allocations may differ slightly from model allocations.

You can get more information by calling (800) 642-4276 or by emailing AdvisorRelations@donoghueforlines.com. Also, visit our Sales Team Page to learn more about your territory coverage.

John A. Forlines III

Chief Investment Officer

Past performance is no guarantee of future results. The material contained herein as well as any attachments is not an offer or solicitation for the purchase or sale of any financial instrument. It is presented only to provide information on investment strategies, opportunities and, on occasion, summary reviews on various portfolio performances. The investment descriptions and other information contained in this Markets in Motion are based on data calculated by Donoghue Forlines LLC and other sources including Morningstar Direct. This summary does not constitute an offer to sell or a solicitation of an offer to buy any securities and may not be relied upon in connection with any offer or sale of securities.

The views expressed are current as of the date of publication and are subject to change without notice. There can be no assurance that markets, sectors or regions will perform as expected. These views are not intended as investment, legal or tax advice. Investment advice should be customized to individual investors objectives and circumstances. Legal and tax advice should be sought from qualified attorneys and tax advisers as appropriate.

The Donoghue Forlines Global Tactical Allocation Portfolio composite was created July 1, 2009. The Donoghue Forlines Global Tactical Income Portfolio composite was created August 1, 2014. The Donoghue Forlines Global Tactical Growth Portfolio composite was created April 1, 2016. The Donoghue Forlines Global Tactical Conservative Portfolio composite was created January 1, 2018.

Results are based on fully discretionary accounts under management, including those accounts no longer with the firm. Individual portfolio returns are calculated monthly in U.S. dollars. These returns represent investors domiciled primarily in the United States. Past performance is not indicative of future results. Performance reflects the re-investment of dividends and other earnings.

Net returns are presented net of management fees and include the reinvestment of all income. Net of fee performance was calculated using a model fee of 1% representing an applicable wrap fee. The investment management fee schedule for the composite is: Client Assets = All Assets; Annual Fee % = 1.00%. Actual investment advisory fees incurred by clients may vary.

The Donoghue Forlines Global Tactical Allocation Benchmark is the HFRU Hedge Fund Composite. The HFRU Hedge Fund Composite USD Index is designed to be representative of the overall composition of the UCITS-Compliant hedge fund universe. It is comprised of all eligible hedge fund strategies; including, but not limited to equity hedge, event driven, macro, and relative value arbitrage. The Blended Benchmark Conservative is a benchmark comprised of 80% HFRU Hedge Fund Composite and 20% Bloomberg Barclays Global Aggregate, rebalanced monthly. The Blended Benchmark Growth is a benchmark comprised of 80% HFRU Hedge Fund Composite and 20% MSCI ACWI, rebalanced monthly. The Blended Benchmark Income is a benchmark comprised of 60% HFRU Hedge Fund Composite and 40% Bloomberg Barclays Global Aggregate, rebalanced monthly.

The MSCI ACWI Index is a free float adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The HFRU Hedge Fund Composite USD Index is designed to be representative of the overall composition of the UCITS-Compliant hedge fund universe. It is comprised of all eligible hedge fund strategies; including, but not limited to equity hedge, event driven, macro, and relative value arbitrage. The underlying constituents are equally weighted. The Bloomberg Barclays Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers.

Index performance results are unmanaged, do not reflect the deduction of transaction and custodial charges or a management fee, the incurrence of which would have the effect of decreasing indicated historical performance results. You cannot invest directly in an Index. Economic factors, market conditions and investment strategies will affect the performance of any portfolio, and there are no assurances that it will match or outperform any particular benchmark.

Policies for valuing portfolios, calculating performance, and preparing compliant presentations are available upon request. For a compliant presentation and/or the firm’s list of composite descriptions, please contact 800‐642‐4276 or info@donoghueforlines.com.

Donoghue Forlines LLC is a registered investment adviser with United States Securities and Exchange Commission in accordance with the Investment Advisers Act of 1940. Registration does not imply a certain level of skill or training.